mass tax connect make estimated payment

Estimated tax payments. Access account information 24 hours a day 7 days a week.

Masstaxconnect Resources Mass Gov

The Massachusetts income tax rate is.

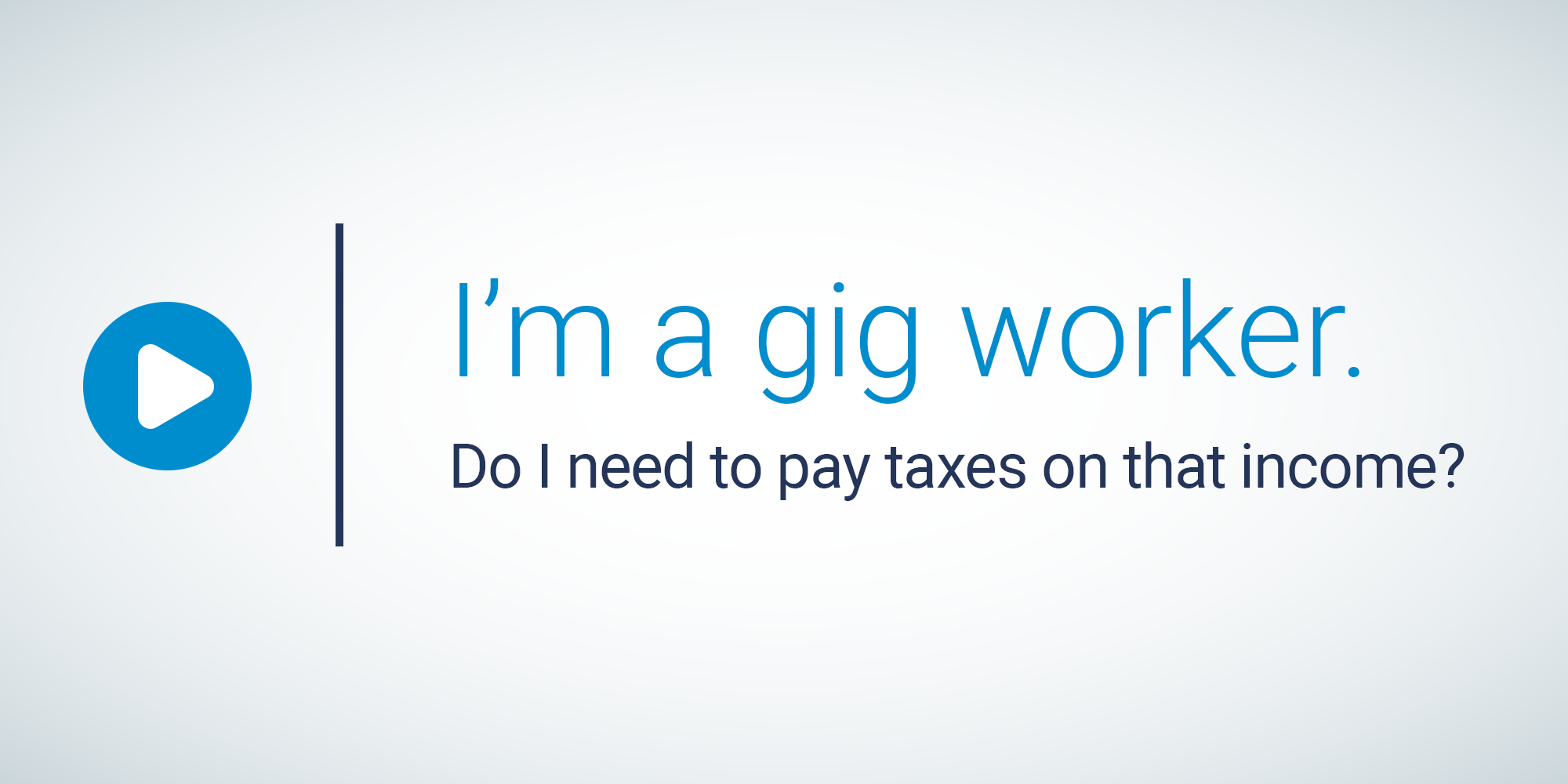

. Business and fiduciary taxpayers must log in to make estimated extension or return. With a MassTaxConnect account you can. Submit and amend most tax returns.

4 pm Monday through Friday. The Massachusetts Department of Revenue DOR replaced their existing e-filing system WebFile. Please enable JavaScript to view the page content.

617 887-6367 or 800 392-6089 toll-free in Massachusetts Visit Contact DOR for more. Tonio lombardi photography malta. Individuals and businesses can make estimated tax payments electronically through.

If you are directly affected by the novel coronavirus. Wisata alam jawa tengah hits. Connect tax tax estimated mass.

If you do not have a payment number call DOR. To make individual payments for multiple taxpayers and accounts. Business taxpayers can make bill payments on MassTaxConnect without logging in.

Mail to Massachusetts Department of Revenue PO Box 419272 Boston MA 02241-9272. You do no need an account. Mass tax connect pay estimated tax.

The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Corporate estimated tax installments are due as follows. Make bill payments return.

Call 617 887-6367 or 800 392-6089. Please enable JavaScript to view the page content. Use this link to log into Mass Department of Revenues site.

Download or print the 2021 Massachusetts Form 1-ES Estimated Income Tax Payment Vouchers for FREE from the Massachusetts Department of Revenue. Contact Center hours are 9 am. Under Quick Links select Make a payment in yellow below.

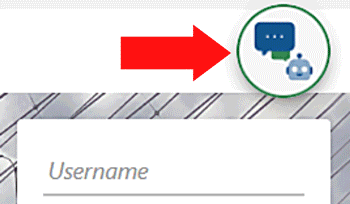

Make your estimated tax payment online. Make a Payment with MassTaxConnect. Youll learn how to pay a tax bill or make an extension or estimated tax payment using the.

Paid in four installments according to the schedule below. Your support ID is. Your support ID is.

Read on for a step by step guide on making tax payments in MA. 40 of estimated tax is due on or before. Its fast easy and secure.

800 392-6089 toll-free in Massachusetts You may also.

Massachusetts Dept Of Revenue Massrevenue Twitter

Masstaxconnect Resources Mass Gov

Massachusetts Dept Of Revenue Massrevenue Twitter

Where S My Refund Massachusetts H R Block

Idaho State Tax Commission Facebook

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Massachusetts Dept Of Revenue Massrevenue Twitter

Advance Payment Requirements Mass Gov

Gig Economy Work And Your Virginia Taxes Virginia Tax

Massachusetts Dept Of Revenue Massrevenue Twitter

Prepare And E File Your 2021 2022 Ma Income Tax Return

Tax Guide For Pass Through Entities Mass Gov

Massachusetts Income Tax H R Block

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov